Medicare Supplement Planning

Relying On Medicare Alone May Not Be Enough

When it comes to selecting the right Medicare plan options to benefit your future needs, there’s no crystal ball to help you decide. The truth is, at the age of 65 you’ll become eligible for Medicare Part A. While this can help to cover important services including hospice care, inpatient hospital and nursing care as well as home health care, it’s not nearly as comprehensive in coverage as what you’re likely to need throughout retirement.

When it comes to filling in the gaps, the good news is you have options. Our team is ready to help those who are at or near Medicare eligibility age to find the right supplemental options that can protect against future financial pitfalls. From coverage of your prescriptions to zero out-of-pocket expenses, there are numerous plans we can comb through to find what fits your needs throughout retirement.

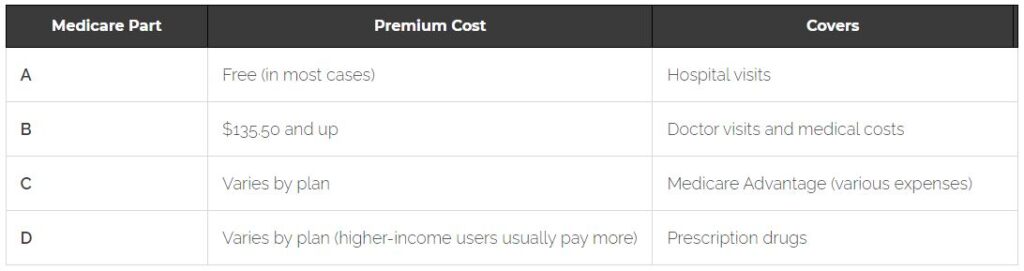

Overview of Medicare Plan Options1

Medicare Part

Premium Cost

Covers

A

Free (in most cases)

Hospital visits

B

$135.50 and up

Doctor visits and medical costs

C

Varies by plan

Medicare Advantage (various expenses)

D

Varies by plan (higher-income users usually pay more)

Prescription drugs

Important Considerations For Choosing Medicare Supplemental Coverage

It is projected that by 2035, the average senior citizen will be spending one in every seven dollars on medical expenses. This is a worrisome 40 percent increase in out-of-pocket medical expenses from studies performed in 20122. Planning now to reduce your medical expenses throughout retirement is more important than ever before. Our team at The Future Years is well-versed in your supplemental Medicare options. We’ll walk you through what’s currently covered, what should be covered and the right strategies for you and your spouse.

Trusting The Future Years With Your Medicare Supplemental Planning

Our retirement income professionals are not tied to any one company or product. That means we can help you compare plans, rates and coverage to find the best options for your unique needs. Along with our services being offered at no additional charge to you, there are a few important advantages of working with us including:

- Competitive long-term rates: We’ll help you understand company rates as they apply to policies now and later, so you can choose the right long-term option at the best rate.

- Support when you need it: As life goes on and your medical needs change, we’ll be here to help you select and adjust your policies as needed throughout retirement.

- Continuous rate review: If things change and we find a better coverage option offered at a lower rate, we’ll keep you updated and informed.

Whether it’s a big brand or lesser-known name, we’ll comb through all of your options to find the best coverage at the right rate for you.