Annuities

Annuities Can Help Provide You With Guaranteed Income for Life

Having a sizable savings account is important as you enter retirement. But when it comes to creating income for your retirement, you may want to consider putting a portion of your money into a more active role through annuities. Instead of accruing interest at a minimal rate, you can put your money to work generating lifelong income.

What Are Annuities?

Annuities are a type of retirement income offered through insurance companies. By entering into an annuity contract, you agree to make payments to an insurance company. That company will invest those funds, and in turn, offer you a set amount of distributed payments once you have reached a predetermined age.

How Do I Know I’m Choosing the Right Insurance Company to Invest in?

Creating a guaranteed income can sound too good to be true. And if you aren’t careful in who you choose to invest with – it often can be. That’s why you need a partner who is experienced in annuities and their effect on retirement income planning to help lead the way. Together we’ll evaluate the important details that surround annuity types, fees and payouts to ensure you’re comfortable with the solutions we present.

Reduce Risk and Establish Stability Throughout Retirement

Your retirement plan likely includes a diverse mix of stocks, bonds and cash. But, when it comes to important qualities of your retirement plan, you need to focus on stability and sustainability. Whether it’s outliving your savings account or succumbing to a downturn in the market, these other sources of income are almost always at risk. By incorporating annuities into your retirement plan, you’re providing yourself with a steady, guaranteed income designed to last your lifetime.

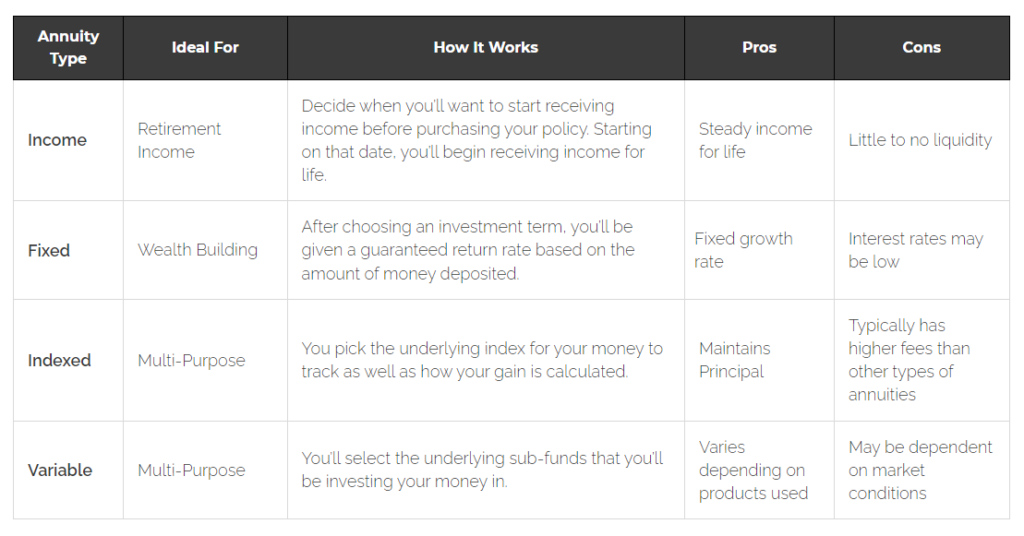

Types of Annuities

Annuity Type

Ideal For

How It Works

Pros

Cons

Income

Retirement Income

Decide when you’ll want to start receiving income before purchasing your policy. Starting on that date, you’ll begin receiving income for life.

Steady income for life

Little to no liquidity

Fixed

Wealth Building

After choosing an investment term, you’ll be given a guaranteed return rate based on the amount of money deposited.

Fixed growth rate

Interest rates may be low

Indexed

Multi-Purpose

You pick the underlying index for your money to track as well as how your gain is calculated.

Maintains Principal

Typically has higher fees than other types of annuities

Variable

Multi-Purpose

You’ll select the underlying sub-funds that you’ll be investing your money in.

Varies depending on products used

May be dependent on market conditions