Social Security Planning

Maximizing Your Social Security Benefits

While a longer life expectancy means more time spent with loved ones, it also presents new challenges for those looking to make their retirement money last. From an increased cost of living to a higher likelihood of medical expenses, too many Americans are outliving their savings. With so many crucial factors coming into play, it’s more important now than ever to be strategic about activating your Social Security benefits.

Why You Need to Strategize Your Social Security

Social Security is much more complex than most retirees realize. While it sounds simple in theory, taking a strategic and timely approach to claiming your Social Security benefits can make a big impact on your retirement income. Why? Because the longer you wait to claim your benefits, the higher the payout you can receive.

Did You Know…

- The earliest age you can begin receiving Social Security benefits is 62?

- Social Security benefits make up approximately ⅓ of the income of America’s elderly population?

- The number of Americans 65 and older will increase from approximately 49 million today to over 79 million by 2035?

- The average monthly Social Security benefit of retirees is $1,46111?

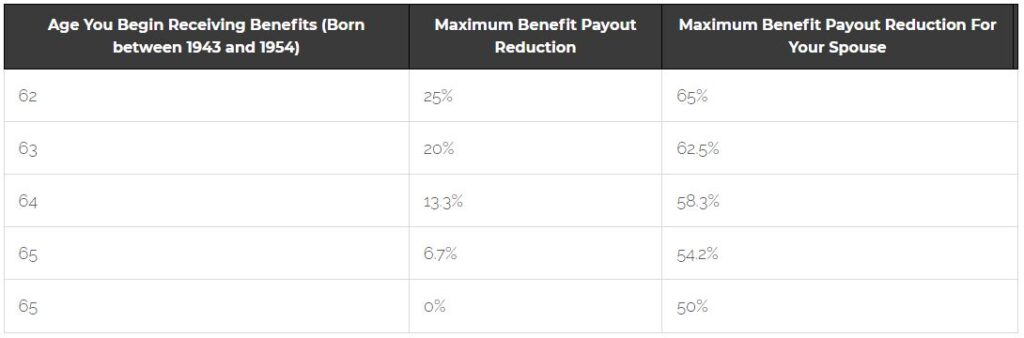

How Age Will Affect Your Social Security Payout2

Age You Begin Receiving Benefits (Born between 1943 and 1954)

Maximum Benefit Payout Reduction

Maximum Benefit Payout Reduction For Your Spouse

62

25%

65%

63

20%

62.5%

64

13.3%

58.3%

65

6.7%

54.2%

65

0%

50%

Common Questions About Social Security

Q: Shouldn’t I Start Social Security Whenever I Think I Need the Income?

A: Not necessarily. While this used to be the common approach to claiming Social Security benefits, today’s savvy retirees are instead weighing their options and discussing with advisors the payout strategies that may be most beneficial in the long run. With life expectancies on the rise, it no longer makes good financial sense to start claiming your benefits early with a reduced rate.

Q: I Regret Applying for My Benefits Early. Can I Do Anything About It?

A: If you applied for your benefits less than 12 months ago, you can withdraw your application and pay back the benefits you’ve already received. This will free you up to reapply at any time. If it has been more than a year and you’re over the full retirement age, you do have the option to suspend your credits and earn an 8 percent delayed credit on the current amount.

Q: What Will Happen to My Benefits If I Go Back to Work?

A: The short answer is, it could ultimately raise your benefits going forward. Here’s why: If you’re under full retirement age, some or all of your benefits could be withheld. $1 will be withheld for every $2 that you earn over the earnings test threshold. While that sounds like a disadvantage to going back to work, it can actually work in your favor. Your benefit will then be recomputed at the full retirement age to remove the actuarial reduction for those months in which your benefit was withheld.

Have More Questions About Retirement?

Maximizing Your Social Security Benefits With The Future Years

To get the most out of your social security benefits, it’s important to consider everything that can affect your social security payout. At The Future Years, we’ll discuss these important factors including cost of living adjustments, delayed start of benefits and the importance of your earning years and retirement start date.

Together, we can help you decide when may be the right time to begin adding Social Security into your retirement income plan.

Contact us today for your free Social Security Review to determine the best strategy available for you.